Your browser is not supported by our website. Some features of the site are not available or will not work correctly. See the procedure to update your browser

Adapting to change is in our DNA.Net-zero ETFs

The world now has a clear target in the fight against climate change: net-zero emissions by 2050.1 But markets are dragging their feet.

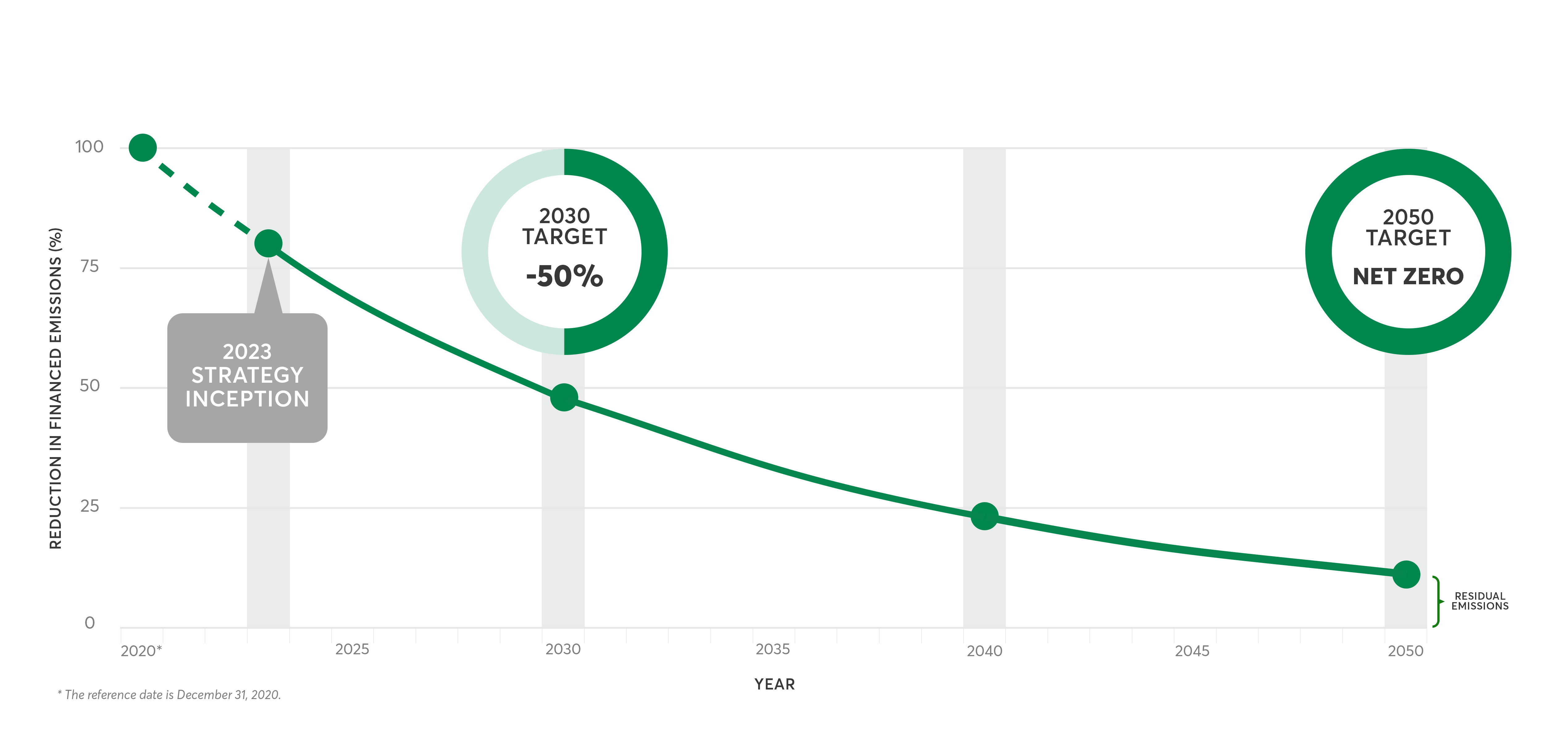

Our Net Zero Emissions Pathway exchange-traded funds (ETFs) are committed to reducing the financed emissions of their portfolios to converge toward the net zero target by 2050, following a defined trajectory.

Important : The reduction targets the ETF's total financed emissions, regardless of the internal policies of the companies held. Future decarbonization prospects are not taken into account.

Financed emissions refer to greenhouse gas (GHG) emissions caused by holding a financial asset, such as company shares or bonds.

In other words, they are emissions linked to our investment choices.

The net-zero emissions pathway ETFs exclude companies that:

Note: The energy sector is not excluded from these ETFs.

In line with the objectives of the RI Net-Zero Emissions pathway (NZE) ETFs, we track the reduction in financed emissions compared to 2020.

See our annual report for additional information.

To reach -50% by 2030, the reduction must be gradual and coherent.

Illustration of the net-zero pathway and its targets.

As of December 31, 2024, all of our ETFs are at least -25% compared to 2020, confirming their alignment with the planned pathway.

| Ticker | Desjardins RI Net-Zero Emissions Pathway ETF | Management fees2 | Progress as at December 31, 2024 | Emissions intensity (CO2/$M) |

|---|---|---|---|---|

| DRCU | Desjardins RI Active Canadian Bond – Net-Zero Emissions Pathway ETF | 0.35% | -61.1% | 31.7 |

| DRMC | Desjardins RI Canada – Net-Zero Emissions Pathway ETF | 0.15% | -31.4% | 101.0 |

| DRMU | Desjardins RI USA – Net-Zero Emissions Pathway ETF | 0.20% | -41.2% | 22.6 |

| DRMD | Desjardins RI Developed ex-USA ex-Canada – Net-Zero Emissions Pathway ETF | 0.25% | -30.5% | 131.8 |

| DRME | Desjardins RI Emerging Markets – Net-Zero Emissions Pathway ETF | 0.35% | -30.9% | 200.0 |

| DRFC | Desjardins RI Canada Multifactor – Net-Zero Emissions Pathway ETF | 0.40% | -32.2% | 99.8 |

| DRFU | Desjardins RI USA Multifactor – Net-Zero Emissions Pathway ETF | 0.40% | -32.7% | 25.9 |

| DRFD | Desjardins RI Developed ex-USA ex-Canada Multifactor – Net-Zero Emissions Pathway ETF | 0.45% | -33.4% | 126.4 |

| DRFE | Desjardins RI Emerging Markets Multifactor – Net-Zero Emissions Pathway ETF | 0.65% | -33.6% | 192.2 |

| ETF name | Management style | Ticker | Management fees2 |

|---|---|---|---|

| Desjardins RI Global Multifactor – Fossil Fuel Reserves Free ETF | Multifactor | DRFG | 0.50% (reduced!) |

The Desjardins RI Global Multifactor – Fossil Fuel Reserves Free ETF is an opportunity to invest in companies with no exposure to the traditional energy sector (coal, oil and gas) to reduce the risks associated with the energy transition.

Desjardins Global Asset Management Inc. (DGAM) is one of the largest portfolio managers in Canada.

The Desjardins Exchange Traded Funds are not guaranteed, their value fluctuates frequently and their past performance is not indicative of their future returns. Commissions, management fees and expenses all may be associated with an investment in exchange traded funds. Please read the prospectus before investing. Desjardins Global Asset Management Inc. is the manager and portfolio manager of the Desjardins Exchange Traded Funds. The Desjardins Exchange Traded Funds are offered by registered dealers.

For advisor use only

This information is confidential and intended only for representatives who are registered with a securities regulatory authority. At no time should this information be shared with investors or included in promotional materials.

Desjardins®, trademarks containing the word Desjardins, and related logos are trademarks of the Fédération des caisses Desjardins du Québec and are used under licence.